are 529 contributions tax deductible in south carolina

In Colorado New Mexico South Carolina and West Virginia 529 plan contributions are fully deductible from state taxable income. Are 529 Contributions Tax Deductible In South Carolina.

Ad Thinking About Saving For Your Childs College Fund.

. For south carolina residents contributions to the sc future scholar program can be deducted on their state. When you contribute to a Future Scholar 529 College Savings Plan you can save for your childs future and save on your state income taxes all at the same time. Ad Getting a Child to College Can Be Stressful.

In fact South Carolina is one of only a. Ad Getting a Child to College Can Be Stressful. Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for.

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME. 1 Best answer. Yes South Carolina taxpayers can claim a tax deduction on the full amount of their 529 plan contribution.

South Carolina How to deduct frontloaded 529 contributions for state income tax purposes. 36 rows Limits on annual 529 state income tax benefits. Although contributions are not deductible earnings in a 529 plan grow federal tax-free and will not be taxed when the money is taken out to pay for college.

Yes as long as certain requirements are met. February 22 2021 1037 AM. Keep More Money Now.

Yes - that is deductible. In your South Carolina return look for the screen Heres the income that South Carolina handles differently. Keep More Money Now.

529 plan accounts accept only cash contributions so the assets in an UGMAUTMA account must be liquidated. Contributions made to a 529 plan technically known as a qualified tuition program or QTP may be deductible for South Carolina income tax purposes. Get Fidelitys Guidance at Every Step.

In addition to a state tax deduction residents can also take advantage of an extended deadline another feature unique to South Carolinas 529 plan. What happens to a South Carolina 529 Plan if not used. Check with your tax advisor.

100 of contributions are deductible but do you deduct a proportional amount from income. Most states limit the amount of annual 529. Other states limit the amount of contributions.

A state income tax deduction. 5 tax credit on contributions of up to 2040 single 4080 joint beneficiary maximum credit of 102 single 204 10 tax credit on up to 2500 single. Residents of South Carolina who are contributing to South Carolinas 529 plan Future Scholar can also enjoy an unlimited deduction on SC state income tax.

The 1099-Q for the. Ad Thinking About Saving For Your Childs College Fund. Get Fidelitys Guidance at Every Step.

There is also no income phase.

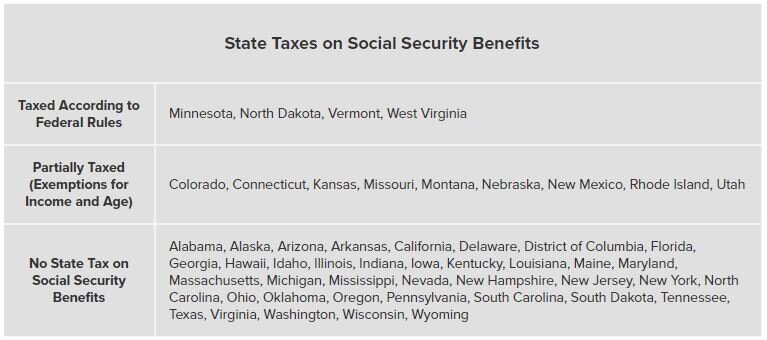

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Rave Reviews For Future Scholar From Those Who Know Sc Office Of The State Treasurer

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

State Treasurer Curtis Loftis Announces New Gift Option Sc Office Of The State Treasurer

State Treasurer Curtis Loftis Announces New Gift Option Sc Office Of The State Treasurer

Cost Of College Calculators 529 Calculator Future Scholar

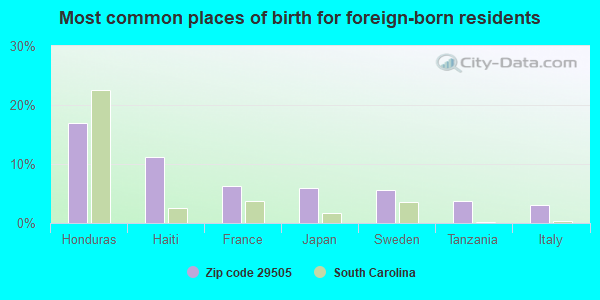

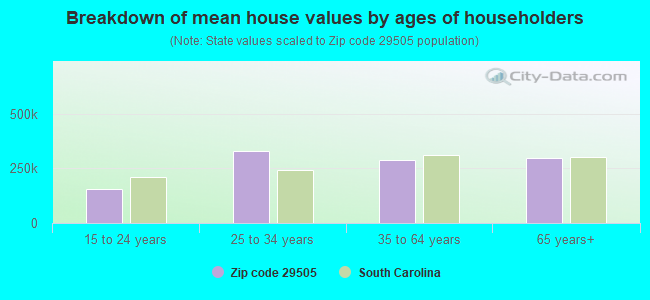

29505 Zip Code Florence South Carolina Profile Homes Apartments Schools Population Income Averages Housing Demographics Location Statistics Sex Offenders Residents And Real Estate Info

29505 Zip Code Florence South Carolina Profile Homes Apartments Schools Population Income Averages Housing Demographics Location Statistics Sex Offenders Residents And Real Estate Info

How Much Can You Contribute To A 529 Plan In 2022

State Treasurer Curtis Loftis Announces New Gift Option Sc Office Of The State Treasurer

What Is A 529 Plan Us News Ultimate Guide To 529 Plans Us News Money

Maryland 529 Plans Learn The Basics Get 30 Free For College Savings

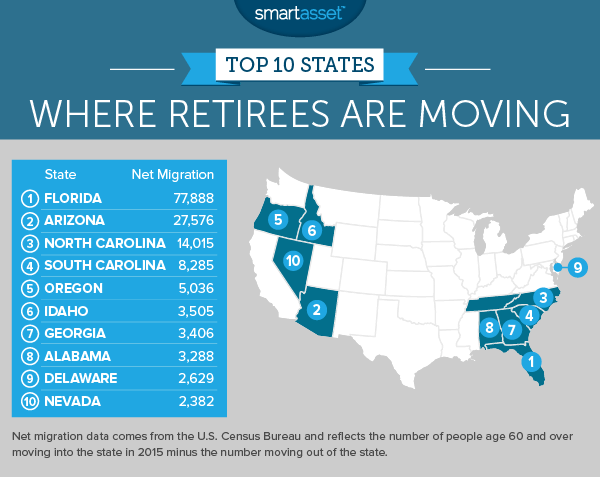

Where Are Retirees Moving 2017 Edition Smartasset

South Carolina Sc 529 College Savings Plans Saving For College